November 13, 2024 – Solganick has published its latest M&A update report on the Technology Services industry sector. The report covers the latest mergers and acquisitions for IT services companies, including application partners and systems integrators, MSPs, cybersecurity and MSSPs, data analytics consulting, and software development firms.

Download the complete report here: Solganick Technology Services M&A Update Q3 2024

Here are the highlights:

- Transaction volume and valuation multiples for technology services companies has remained solid during the third quarter of 2024, continuing to exceed pre-pandemic levels in aggregate. Strategic buyers were more active than financial buyers in Q3 2024, with companies including Accenture and Deloitte announcing transactions.

- We expect M&A deal volume to increase in the technology services sector for the remainder of 2024 and continue into 2025.

- Artificial Intelligence, data analytics, cloud computing, cybersecurity, and software development competencies are strongest in demand and are expected to remain key areas of interest for buyers during the remainder of the year.

- Demand for specialty IT consulting firms supporting application software platforms continues to be very strong, particularly for partners of applications supporting large and growing market opportunities (e.g., AWS, Google Cloud, Microsoft Azure, Snowflake, Databricks, ServiceNow, Salesforce, and others).

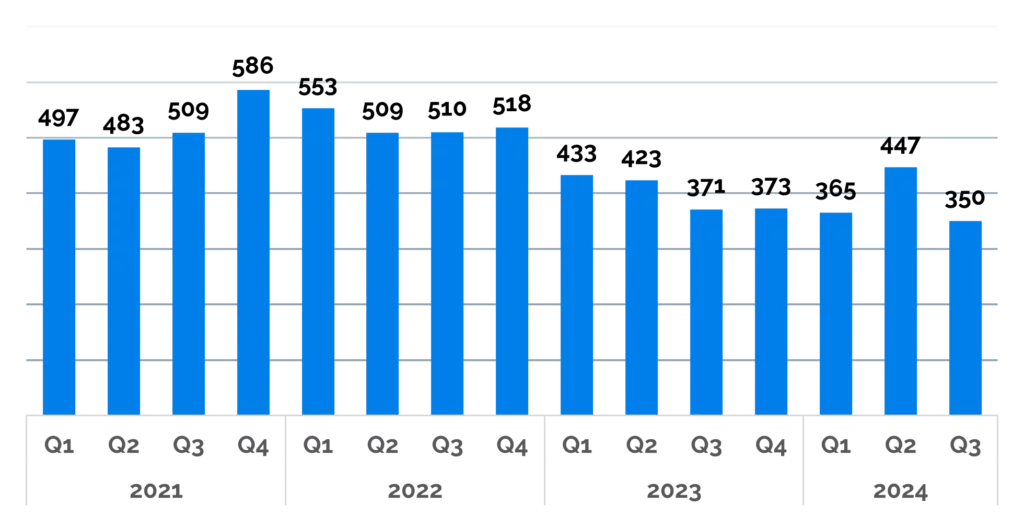

- In Q3 2024, there were 350 M&A transactions announced within the Technology Services sector.

- The Average deal volume is 462 transactions from Q1 2021 to Q3 2024. Thus, this quarter was down overall.

Application Partners (Systems Integrators)

- The M&A market for application partners (including systems integrators) showed resilience in Q3 2024 compared to the broader M&A market.

- Financial buyers, particularly private equity firms, have kept M&A volume afloat in the systems integration sector, accounting for 57.1% of all transactions through YTD 2024.

- Private equity buyers have opted to acquire systems integration businesses almost exclusively through their established portfolio companies.

- In summary, private equity-backed consolidation and the shift towards integrated technology solutions drove deal activity and insulated the systems integration sector from the pressures of the broader M&A market.

Notable M&A transactions in the applications partner and systems integrator sector include: IBM’s acquisition of Oracle partner, Accelalpha, Carlyle Groups acquisition of SAP partner, Seidor, and Insight’s acquisition of ServiceNow Elite Partner, Infocenter.

Cybersecurity Services

- The cybersecurity services M&A market in Q3 2024 improved sequentially but declined over the prior year and remained below elevated levels in 2021 and 2022.

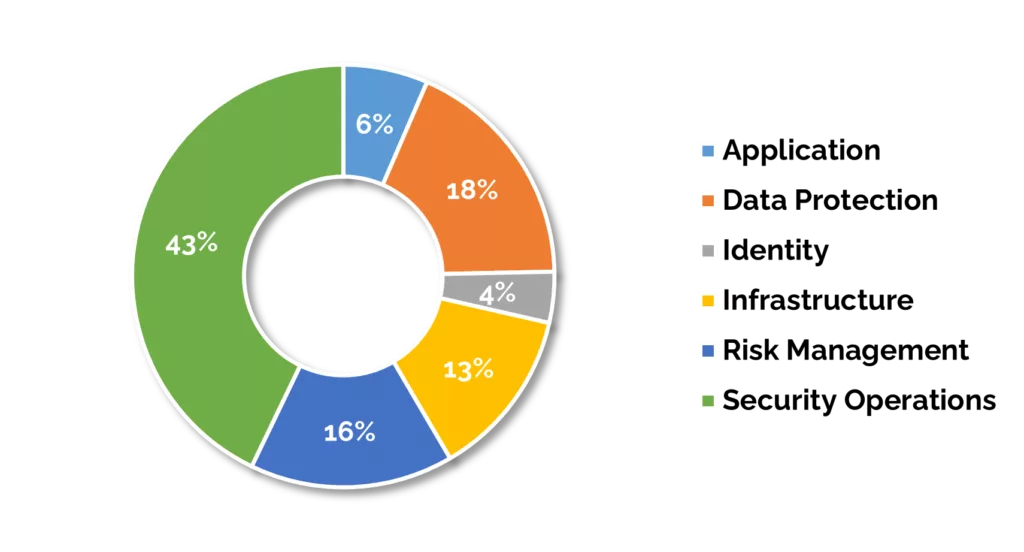

- Security Operations constituted the largest subsector in Q3 2024, driven by the consolidation of managed security services and incident response providers.

- Key drivers for M&A activity of cybersecurity services included geographic expansion, complementary expertise/verticals, and automation enhancements.

- Strategic buyers were significantly more active than financial buyers, continuing the trend from recent quarters, reflecting higher borrowing costs and uncertainty.

- Cybersecurity M&A activity is expected to accelerate in 2025, benefiting from potential interest rate cuts and valuation realignment as sellers seek liquidity.

- Venture funding for cybersecurity startups totaled $2.2B in Q3 2024, nearly flat with the prior year, with substantially fewer but much larger average rounds.

Notable M&A transactions in the cybersecurity services sector include Dataprise’s acquisition of Phx-IT, Fortress’s acquisition of Fulcrum IT Partners, Difenda’s acquisition of Quorum Cyber, and Oakley Capital’s acquisition of i-Tracing.

Data and Analytics Consultancies

- The M&A market has seen a slight rebound in 2H 2024, with a shift towards smaller transactions rather than large megadeals. The data analytics sector, in particular, is anticipated to see an increase in M&A activity throughout the remainder of 2024 and into 2025, especially around emerging technologies like data analytics and generative AI.

- In our current and recent engagements, we are seeing particular interest in firms providing services in and around Snowflake, Databricks, Looker, AI, and other ecosystems.

Notable M&A transactions in Q3 2024 include Talan acquires Micropole, Sparq’s acquisition of Amplify, Cleartelligence’s acquisition of Bardess, and Globant’s acquisition of Exusia.

Managed Services Providers (MSPs)

- The managed services provider (MSP) industry saw strong M&A activity in Q3 2024.

- The MSP industry “is in a rapid state of consolidation,” with more than 60 listed MSP transactions in the U.S. alone since January 2024.

- Several aspects of the MSP business model, such as predictable revenue streams, strategic customer relationships, and scalable services, make MSPs an attractive investment for both larger IT service providers and financial investors.

- Technology research firm, Canalys, expects MSP M&A activity to grow 50% in 2024, returning to 60% of 2021 levels, as the surge in cloud migrations, outsourced IT, and increasing cybersecurity complexity fuel demand.

- The MSP industry saw a strong rebound in M&A activity in Q3 2024, with a high volume of transactions and experts predicting continued consolidation in the sector into 2025.

- PE firms continue to remain buyers of MSPs due to the high amount of recurring revenue they generate.

Notable M&A transactions include Recognize acquires Blue Mantis, Kingsway acquires IS Technology, Magna5 acquires Fullscope IT, New Charter Technologies acquires Dynamic Edge, and several others.

Software Development Services Firms (including software product engineering)

- The software development services market is expected to see increased M&A activity in 2024, driven by a few key trends:

Demand for Vertical SaaS Solutions: Vertical SaaS solutions, which address industry-specific challenges, are expected to generate more M&A interest than horizontal SaaS peers in 2024. This aligns with the growing need for tailored software solutions. - Shift to Profitability over Growth: The market is shifting away from “growth at all costs” to a focus on profitability. Acquirers are targeting software development firms with strong product technology, market fit, and healthy business models.

- Consolidation in Cloud, Analytics, IoT, and AI/ML: Software development firms will look to acquire critical technology capabilities in areas like cloud, analytics, IoT, and AI/ML to keep pace with evolving customer demands. Understanding and building AI applications is seen as critical for software development firms to stay competitive.

Software Development M&A transactions announced in Q3 2024 include Globant’s acquisition of Blank Factor, IBM’s acquisition of SixWorks, EQT’s acquisition of Keywords Studios, and Cognizant’s acquisition of Belcan.

About Solganick

Solganick & Co. has provided software and IT services focused investment banking for over 15 years and has completed over 200 M&A transactions to date. The firm and deal team use a proprietary data-driven approach to providing customized M&A advisory services for fast-growing and established technology companies. For more information please contact us.

harris williams technology services M&A trends and update, zinnov technology services M&A report, equiteq technology services M&A report, woodside capital partners IT services M&A industry report, KPMG Corporate Finance Technology Services Industry Update, BMI Mergers & Acquisitions IT Services market report, harris williams IT services report, houlihan lokey IT services and technology services, aventis advisors IT services, EY technology services M&A report, hampleton partners IT & business services report